The White House told us last year that Inflation is transitory. We know how that ended. Now we are told we won’t enter a recession. Here’s where our history tells us we are headed.

The post Who Do You Trust — Our Government or History? appeared first on Gold Alliance.,

A national survey in August 2022 found that almost 60% of Americans think the country is in a recession, and that they blame Joe Biden and the Democrats. The continued problems of Covid infections and inflation hit low- and middle-income citizens especially hard in 2022.

The Fed’s response: too little, too late?

The US inflation rate started soaring in early 2021, but our government still ignored the concerns and claimed it was temporary. Here’s President Biden in July 2021:

“Our experts believe and the data shows that most of the price increases we’ve seen [were] expected and [are] expected to be temporary.”

Federal Reserve Chairman Jerome Powell also pooh-poohed fears of inflation:

“As these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal [2%].”

Inflation erupted in full force in the second half of 2021, but the Fed waited until March 2022 to react, raising the federal funds rate a paltry 0.25% while Chairman Powell assured the public that “the economy is very strong and well positioned to handle tighter monetary policy.”

But faced with the harsh inflation reality, Secretary of the Treasury Janet Yellen — who had initially called the risk of inflation “small” and “manageable” — seems to comprehend that official did not “fully understand” the shocks that “shook the economy so badly.” And Fed Chair Powell recently said: “We now understand how little we understand about inflation.”

So, after realizing inflation is much worse than the Fed hoped, we’re now two 0.75% rate hikes further into the Fed’s fight against inflation, and Powell has told Congress that the Fed is determined to bring down inflation, which will likely mean more rate hikes. And more rate hikes, based on our history, will most likely slow the economy and send us into a recession.

But never fear! The Fed and the White House are back to predictions again, and their latest prediction is that a recession won’t happen. James Bullard, President of the Federal Reserve Bank of St. Louis, said in mid-July that he is “a little skeptical that we’ll get into a recession.” He believes that the economy is strong and that the Fed has the right policy to bring inflation down to 2% in 18 months.

Biden is on the same page, telling reporters on July 25 that “We’re not going to be in a recession.”

That begs the question: If our government doesn’t understand inflation, can we trust them to understand recession?

The historical link between inflation and recession

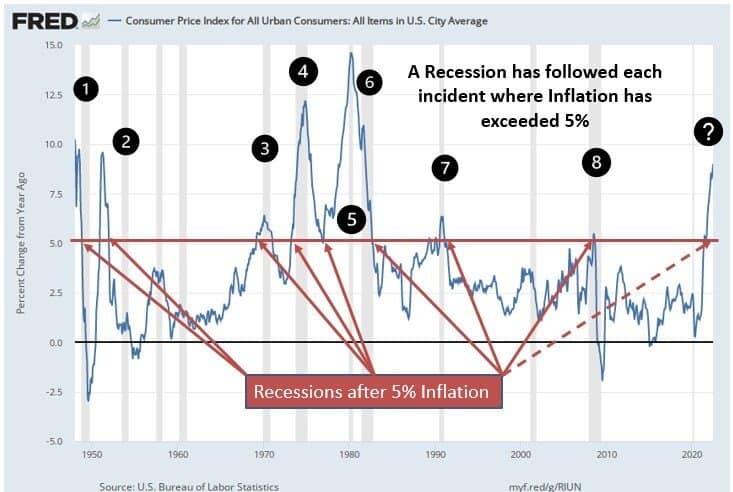

I’ll let you answer that question for yourself. Outside of the Fed and the White House, however, more and more economists and analysts are warning of a recession. And if we look at the historical link between high inflation and recessions, the data suggests that a recession will follow the Fed’s heavy-handed approach to monetary policy: Since 1975, the economy has entered a recession within 18 months of inflation rates reaching 5%.

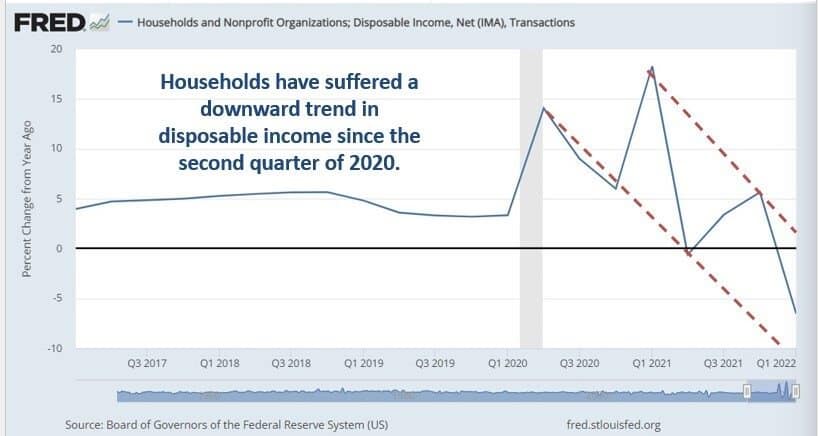

The reason is very simple: Consumer spending is needed in order to keep the economy going and avoid a recession. But inflation is hurting Americans’ pocketbooks. Consumers need to put a huge chunk of their disposable income towards essentials like gas and food, so they have less money to put towards other increasingly expensive products and services.

Since consumer spending makes up about 70% of GDP, falling disposable personal income means that consumers have less money to spend the economy out of recession.

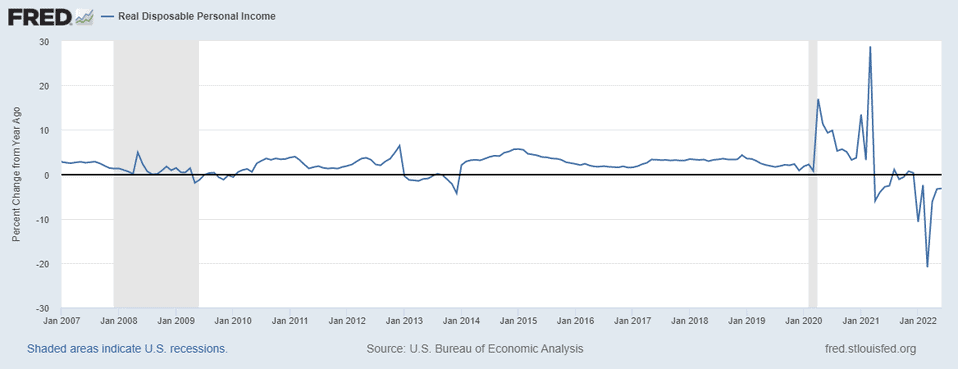

According to the Bureau of Economic Analysis, real disposable personal income decreased 7.8% in the first quarter of 2022, which followed a drop of 4.5% in the fourth quarter of 2021.

Just how severe is the collapse? It’s worse than in 2008:

So, if demand is going to save the economy from a recession, it’s not going to come from consumers.

Are we already in a recession?

A rule of thumb is that “two consecutive quarters of decline in a country’s Gross Domestic Product constitute a recession.” GDP dropped 1.6% in the first quarter of 2022 and 0.9% in the second quarter, so following that definition we’re already in a recession.

The Fed’s James Bullard chooses to dismiss that: “We’re not in a recession right now. We do have these two quarters of negative GDP growth. To some extent, a recession is in the eyes of the beholder,”

Perhaps the Fed actually thinks that we aren’t in a recession or headed towards one. Just like they thought inflation was nothing to worry about until they could no longer dismiss it. Either way, choose who you trust and decide whether you need to take action.

The post Who Do You Trust — Our Government or History? appeared first on Gold Alliance.

,